We are often asked if international buyers can use mortgages to finance property purchases in Spain. We’re pleased to confirm that Spanish banks will grant mortgages to non-residents.

Each bank has their own lending criteria

However this is subject to each bank’s own lending criteria and it can be a challenge to identify the bank that will suit a potential borrower’s profile. One bank might decline a mortgage that would have been approved by another. Despite this, there are some general parameters that apply:

The percentage of the property cost that is mortgaged is known as the Loan-to-Value (LTV) percentage.

For non-residents (who don’t pay tax in Spain) the maximum LTV is 60-70%% but it depends on the property price and financial profile of the buyer. In terms of what you can borrow, the bank will consider your Debt-to-Income ratio (DTI). They will require that approximately one-third of your net monthly income covers your existing debts including any rent you might pay plus the new Spanish mortgage.

Use an expert Spanish mortgage broker

While clients are free to make a mortgage application with any bank they choose another option is to use a mortgage broker.

The advantage of a broker is that they understand the banks’ eligibility criteria and will only refer to banks suited to a client’s profile. They can also help present supporting documents in the best light and talk a client through the application process. Since 2019, the Spanish mortgage industry has been regulated by the Bank of Spain and only licenced brokers can continue to act as an intermediary between the client and the bank as the application progresses.

The mortgage process

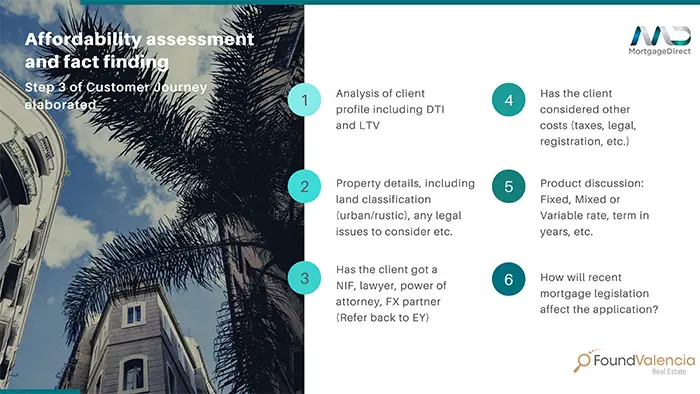

Whichever application route is chosen the mortgage process will include the following key stages:

- The bank will assess the application, study the supporting documentation – requesting additional information or clarification if necessary – and then accept or decline the mortgage.

- On acceptance, the lender will instruct an independent valuer and request payment of the valuation fee.

- If the valuation is suitable, the bank will confirm the conditions and will then liaise with the client, their agent and both parties’ lawyers and stipulate the funds that must be made available in the client’s account. Once the funds are in place, the arrangements for completion can be made.

- Completion takes place at a notary office and must be attended by the client or their legal representative. After the deeds have been signed, the cheques are distributed, the keys are handed over and the mortgage process is completed.

Found Valencia has chosen to collaborate with Mortgage Direct over other brokers/intermediaries. They have been operating in Spain since 2006 and since then have cemented their place as the leading independent broker in Spain.

They were one of the first brokers to achieve the Bank of Spain’s official licence (introduced in 2020), are completely independent and have a wealth of experience in a market where contacts are everything and premium service is key. Contact Mortgage Direct for a free no-obligation quote.

If you want to know more in detail the complete process to apply for a mortgage, you can download the attached pdf file.

Attachments

- Found Valencia – Customer Journey.pdf (564.474 kibibytes)